Can New Buildings Be Rent Stabilized? Yes, They Definitely Can

Can New Buildings Be Rent Stabilized? Yes, They Definitely Can

This article was written by the team of housing experts at JustFix

Summary

Even newer buildings can be rent stabilized because the landlord participates in a tax abatement program.

What can JustFix do?

Research your building through our online tool, Who Owns What

Most New Yorkers associate rent stabilization with old buildings, low rents, walk-ups, and, let’s face it, neglectful landlords who fail to make even the most basic repairs.

But, thousands of newly constructed apartments should come with rent stabilized leases because the owners of these developments receive special tax breaks. Many of these “modern” apartments have elevators, gyms, recreation rooms, and roof decks. Despite laws that compel landlords to inform their tenants of the apartment’s stabilized status due to the tax abatement, thousands of tenants have no idea they live in rent stabilized apartments.

With some important exceptions, rent stabilization generally applies to buildings of six or more units built after 1947 and before 1974. Until the state rent laws changed in 2019, vacant apartments that reached a certain “legal rent” (between roughly $2,000-$2,700 in recent memory) lost their status as rent-regulated and turned into “market apartments.” Landlords who fully renovated entire buildings also took advantage of loopholes in the Rent Stabilization Code to convert the entire building into “market rate” apartments. For this reason, many New Yorkers associate rent stabilizations with larger, older buildings with low(er) rents. But that’s often not the case.

Rent Stabilization Through J-51 and 421-a Tax Abatement Programs

J-51 and 421-a, the two most common tax abatements, offer owners incentives to renovate or create new residential apartments. In exchange for these tax benefits, owners have a few key obligations to their tenants:

Strong Eviction Protections: No matter how high the rent starts off (often landlords get to set the first rent based on the local “market”), the owner must offer a rent stabilized lease for the entire period of the tax benefits (usually 25 years). Even if the rent starts off relatively higher, in New York City, the Rent Guidelines Board (“RGB”) sets the yearly rent increase at usually modest amounts (1-2% in the last few years). In addition, the owner can only end the tenancy for “good cause.” In other words, no matter how much a tenant might complain or cause the landlord aggravation, the owner must continue to renew the lease and can’t abruptly jack up the rent.

Strong Notice Requirements: Not only must a landlord receiving 421-a or J-51 benefits offer a rent stabilized lease, but the owner must inform the tenant about the tax abatement program in 14-point font in every single lease, including the first lease and all renewal leases. All leases need to clearly inform the tenant of the date on which the tax abatement will expire. This is important because once the tax abatement expires, the apartment loses its status as rent stabilized. If a landlord fails to provide notice to the tenant of the tax abatement and its expiration date, the landlord can never remove the apartment from rent stabilization.

Researching Whether Your Building Has A Tax Abatement

There are a few ways to check if your building receives J-51 or 421-a:

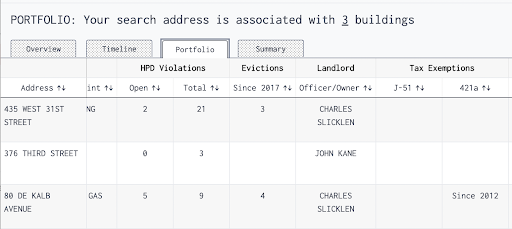

Check your building status with JustFix’s Who Owns What (“WOW”) tool. WOW now flags if a building receives J-51 and 421-a tax abatements. Look up any address and navigate to the Portfolio Tab to look for evidence of the tax abatement under the “Tax Exemptions” column.

Use CoreData.nyc to visualize properties with tax abatements. Created by NYU Furman Center, CoreData incorporates public information into an interactive data and mapping tool. Information like subsidized housing, demographics, zoning regulations, neighborhood conditions and more are all options you can overlay onto the map.

Review government websites. The City of New York maintains a list of buildings receiving tax abatements. Check out the New York City Department of Housing Preservation and Development (“HPD”)’s list of J-51 buildings by borough and year. Visit the Department of Finance (“DOF”)’s database for a list of 421-a buildings.

Getting Your Landlord To Recognize Your Rent Stabilized Rights

Even if your landlord does not offer you a rent stabilized lease, go ahead and sign the lease anyway! You can make a complaint with the NYS Division of Homes and Community Renewal (“DHCR”) to ask that they declare your apartment rent stabilized. Your apartment should remain rent stabilized for your entire tenancy because the owner failed to properly alert you of the tax abatement. To request recognition as a rent stabilized tenant, write a letter to DHCR asking for an “administrative determination” that your apartment is rent stabilized.

Provide a copy of all your leases (first and any renewals) as well as any government websites showing that your building has (or had when you moved in) J-51 or 421-a benefits. You can mail these documents to:

Director, Multi-Service Unit

Property Management Bureau

92-31 Union Hall Street

Jamaica, NY 11433

Getting recognized as rent stabilized is just the first step in your journey to stable, long-term rental housing. Next, you need to file a rent overcharge complaint to get your rent lowered and recoup past overpayments (plus potentially damages and interest). In addition to your leases, you’ll need to provide rent bills and proof of past rent payments.